Best Investment Options in India in 2025

Best Investment Options in India in 2025

1. Why 2025 is a crossroads for Indian investments

India finds itself at a compelling juncture. A wide array of global capital flows, domestic reform momentum and sectoral shifts are converging to create new investment possibilities.

-

According to the investment-promotion agency Invest India, the Indian economy in 2025 is seeing major push-areas such as technology services, renewables, healthcare and infrastructure. News on Air+4Invest India+4businessremedies.com+4

-

For example, in the land & development site category (cross-border capital flows) India secured significant foreign investment during the 12 months ending Q1 2025, helping cement its spot among the top 10 global markets. The Times of India

-

In the financial-markets commentary space, analysts note key trends shaping the investment landscape: ESG funds, mutual-fund flows via SIPs, alternative investment vehicles are all seeing meaningful growth. The Economic Times+1

-

Several high-growth sectors are spotlighted for 2025: IT / digital services, consumer goods, healthcare & pharma, infrastructure / capital goods. The Financial Express+1

All of which suggests: for the investor in India, now is time to re-assess traditional safe-havens and also explore the higher-growth plays — with a balanced view on risk, horizon and diversification.

(What is the safest place to keep money in 2025?)

2. Key Investment Themes & Sectors for 2025

Here are some of the sectors where structural backing and market momentum are visible.

a) Technology & Digital Services

With digitisation, cloud, AI and global outsourcing demand increasing, India’s tech sector remains a key growth pillar. Invest India projects that by FY26, the tech services export thrust could cross the $300 billion mark. Invest India+1

Implication for investors:

-

Consider equity exposure (via mutual funds, large-cap IT stocks) in companies with global delivery models.

-

Keep an eye on domestic tech infra / service providers enabling cloud, AI, SaaS.

-

Note that valuations may get rich — so patience and selection matter.

b) Renewables & Clean Energy

India has committed to large renewable capacity goals (for example, the 500 GW by 2030 target) and is actively deploying solar, wind and energy-storage grids. Invest India+1

Investor take:

-

Renewable energy companies, power-storage plays, clean-grid infrastructure may offer growth potential.

-

A hedge/trend-investment in green bonds or ESG-funds could also be considered.

-

Risks include: policy/regulatory change, execution delays, technology cost shifts.

c) Healthcare & Pharmaceuticals

India is already a major pharma producer (especially generics & vaccines) and increasingly moving into biotech, digital health and telemedicine. Invest India+1

Why invest here:

-

Rising domestic demand due to population/ageing/urbanisation.

-

Export opportunities remain strong.

-

Innovation (e.g., biotech) adding upside, though risk is higher.

d) Infrastructure & Capital Goods

With government programmes like the Smart Cities, major highways, industrial corridors, and the push for manufacturing, the infrastructure / construction / capital goods sector is seeing tailwinds. For example, the CAGR for infrastructure investment is projected ~15.3%. Invest India+1

Investor view:

-

Infrastructure stocks, engineering/construction companies, material suppliers might benefit.

-

Also consider real‐estate opportunities in Tier-2/3 cities supported by new demand. businessremedies.com

-

These are generally longer-horizon, execution-risk areas.

e) Consumer Goods / FMCG

India’s large and young population, rising disposable incomes and changing consumption patterns mean the consumer goods sector (especially branded products, urban & rural penetration) remains promising. Invest India+1

What to look for:

-

Companies with strong brands, distribution reach, ability to penetrate rural markets.

-

Be mindful of margin pressures (commodity costs, competition) though.

-

(How can I earn 1 CR in 10 years?)

3. Financial Instruments & Safe / Steady Picks

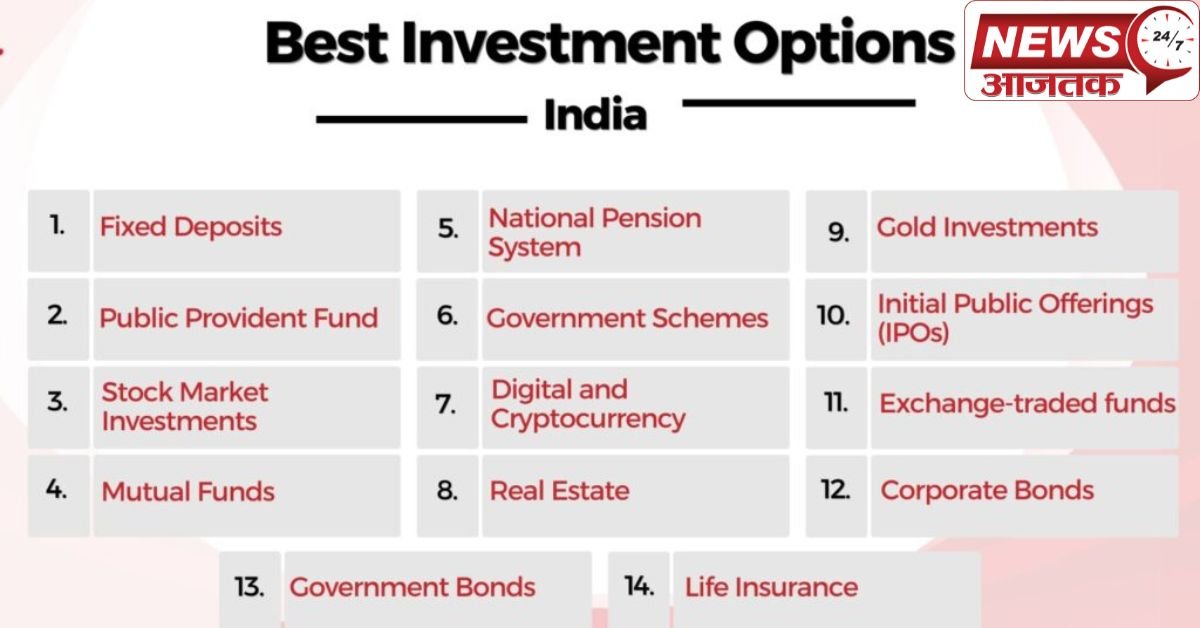

Beyond thematic sectors, the more core “investment options” for individual investors deserve attention. Here are some of the popular ones in India in 2025.

• Mutual Funds / SIPs

Especially equity mutual funds (large-cap, multi-cap) and Systematic Investment Plans (SIPs) continue to attract Indian retail investors. For example, SIPs in India were bringing in regular flows and are seen as backbone of retail investing. The Economic Times+1

Why use them: Diversification, professional management, long‐term horizon leverage.

Check: fund performance, expense ratio, asset‐allocation alignment with your risk profile.

• Government-backed safe-options (PPF, FD, SGBs etc)

For conservative investors, government-saving instruments retain relevance. Some recent commentary lists:

-

Public Provident Fund (PPF): ~7% returns (2025 era) with long lock-in. RupeeSathi –+1

-

Fixed Deposit (FDs): 6.5-8.5% depending on tenure. Motilal Oswal+1

-

Sovereign Gold Bond (SGBs): A way to gain from gold, via government‐issued bonds. Motilal Oswal

Takeaway: If your risk appetite is low, or you want to anchor part of your portfolio in “safe” instruments, these remain valuable. The trade‐off is lower returns and, for some, longer lock‐ins.

• Alternative Instruments – REITs / AIFs / ESG-Funds

A growing trend in 2025 India is alternative investment vehicles. For example, REITs (real-estate investment trusts) and AIFs (alternative investment funds) are gaining traction in the high-net-worth brackets. The Economic Times

Why consider: Diversification beyond traditional stocks/bonds; access to real estate or thematic assets.

Caveats: Higher minimums, maybe lower liquidity, and possibly higher risk/complexity.

4. Putting it all together: A Suggested Framework

Here’s a practical framework you might use (adapting to your own goals & risk) for investing in India in 2025:

-

Define your horizon & goal – Are you investing for 5 + years, 10 + years, or a short-term goal (2-3 years)?

-

Split your portfolio into “core” + “growth” buckets:

-

Core: safer instruments (PPF/FDs/SGBs, large‐cap equities)

-

Growth: thematic sectors (tech, renewables, infra, healthcare)

-

-

Stay diversified – Don’t put all your eggs into one sector. Even high-conviction themes can falter on execution, regulation or valuation risks.

-

Regular investing – Using SIPs in mutual funds helps average out market volatility.

-

Stay updated & flexible – The investment-landscape is evolving: valuations matter, new regulations matter, global macro matters.

-

Risk & liquidity check – For each investment ask: “If I need money in 3 years, will I be comfortable?” “How much could I lose in a downturn?”

-

Tax & cost awareness – Know the tax implications (especially for instruments like ELSS, PPF, NPS) and costs (fund expense ratios, brokerage, exit loads).

5. Risks & Things to Watch

No investment path is without risks, and in India in 2025 some of the key caveats are:

-

Valuation risk: In growth sectors like tech or renewables the valuations may be lofty; future returns may hinge on execution and earnings delivery (not just optimism).

-

Regulatory & policy risk: Sectors like clean-energy, pharma, infrastructure are often policy-sensitive. A policy reversal or subsidy change could hurt.

-

Execution risk: Particularly for infrastructure, large-cap goods, and real-estate in Tier-2/3 cities. Projects get delayed, cost overruns happen.

-

Liquidity & exit risk: Some alternative investments (AIFs, certain real-estate trusts) may not be as liquid. If you need money early you may face constraints.

-

Global macro / interest rate risk: India doesn’t operate in isolation. Global interest rate moves, currency shifts, foreign capital flows all impact Indian markets.

-

Over-concentration risk: The temptation to chase a high-hyped sector is strong. Balanced allocation matters.

6. Key Takeaways for the 2025 Investor in India

-

2025 is less about “one single best investment” and more about allocation across themes and instruments.

-

For growth: sectors such as tech/digital services, renewable energy, healthcare/pharma, infrastructure remain structurally promising.

-

For stability: continue anchoring part of your portfolio in government-backed savings (like PPF/FD) and broad-market equity mutual funds.

-

Use SIPs and regular investing rather than trying to “time the market”.

-

Keep your horizon long (5 + years) especially for growth instruments.

-

Re-visit your portfolio regularly (at least annually) and rebalance if allocation gets skewed.

-

Be extra careful about high-risk, high-velocity plays unless you understand them well.

7. Final Word

If you’re looking at “where should I invest in India in 2025?”, the answer isn’t a single product — it’s a strategy. A strategy that blends safety, growth, diversification, and discipline. The themes are in place: the Indian economy is showing credible structural growth drivers, sectors are opening up, and financial markets are evolving. What it demands from you as an investor is clarity of goal, tolerance for risk, patience, and a smart mix of instruments.

Remember: long-term investing wins not by chasing every hot trend, but by staying invested, adjusting to changing realities, and keeping costs & risk in check. 2025 in India can be a strong year — but only if the investment decisions are consistent and grounded, not purely speculative.